Futures is a popular instrument used for commodities, precious metals, gas, etc. The essence is “betting” on the future commodity’s price and generating income from the right prediction. Futures trading is possible on the cryptocurrency market as well.

What is futures in crypto? Futures are agreements where traders set the price at what they will purchase or sell digital assets on some exact day.

Crypto Futures Meaning

This financial tool allows for generating income on both growing and dropping markets. How to trade crypto futures? Imagine you did market research and concluded that the BTC price would grow in the near future. So you enter into a contract and pre-set the price you think BTC will reach by some exact day in the future. If your forecast is correct, you sell your BTC at a higher value when the contract is over and receive income from the price difference.

Another situation is when you estimate that the BTC price will drop. So you enter a contract and set a lower value in it. When the day comes, you owe to buy BTC at a lower price. In both cases, you generate income if you predict the price movement correctly.

Why did we use BTC in the example? Bitcoin is the most popular crypto asset with the highest level of liquidity. The asset is always in demand, and its price is not very volatile compared with other crypto assets. That is the reason why BTC is often used in futures trading.

Where Can I Trade Futures?

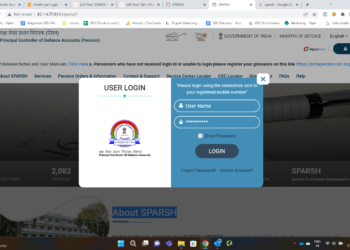

Crypto futures are available on the following crypto exchanges:

-

FTX

-

WhiteBIT

-

Binance.

The WhiteBIT crypto futures trading platform offers futures trading options with all popular crypto assets and allows to use leverage. Leverage is borrowed funds that help enter futures contracts with better positions and, thus, multiply your income as a result. Look for more information on futures trading on the WhiteBIT blog.